Childcare Vouchers and Tax Free Childcare

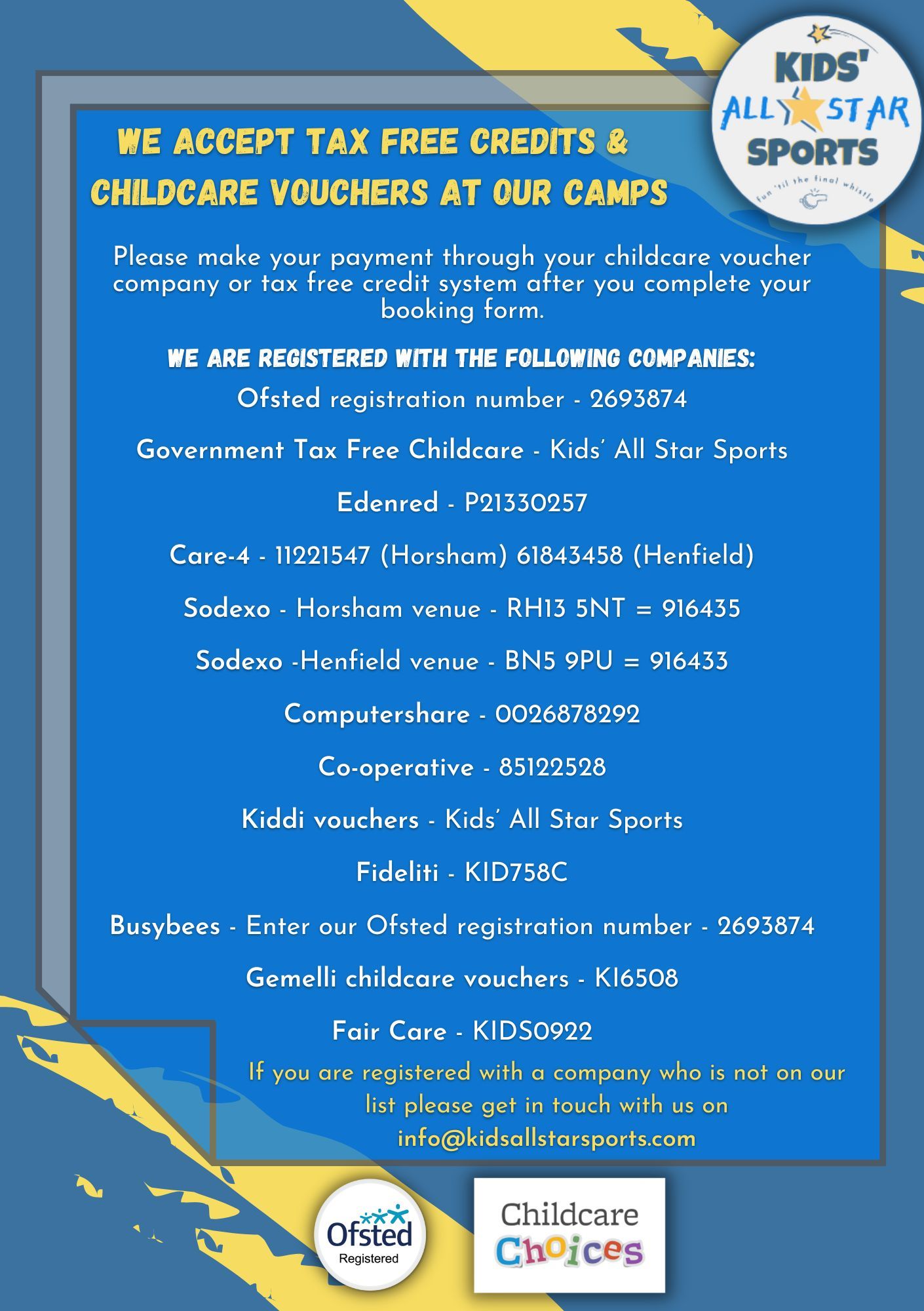

As Kids’ All Star Sports is Ofsted registered, you can use Tax-Free childcare to pay for your school holiday activities with us.

We also accept Childcare Vouchers and know that many parents use both methods of payment. As Childcare Vouchers are no longer offered to new employees, if you’ve started a new role since 2018 you won’t have this option.

What is Tax Free childcare?

Tax-Free childcare is a government-backed scheme which offers eligible families up to £2,000 per child per year (or £4,000 for disabled children) free to put towards childcare costs.

The government will give you 20% additional funds for what you pay into your account. For every £8 you pay in, the government will automatically add £2, effectively giving you basic rate tax back on what you spend.

Parents can't claim childcare tax credit (childcare element of working tax) or universal credit if they receive Tax-Free childcare.

Tax-Free childcare is available to:

- Working families, including the self-employed, in the UK

- Those earning under £100k and at least the National Minimum or Living wage equal to 16 hours a week

- Those who aren't receiving Tax Credits, Universal Credit or Childcare Vouchers

- Families with children aged 0-11 (or 0-16 if disabled)

Find out more here.

Childcare Vouchers

You can use childcare vouchers as full or part payment. This can be highlighted when going through the booking process online. If you don't pay via childcare vouchers 10 days after booking your place will be automatically removed.